Wire transfers, also known as money transfers, are a tried and tested method of sending money, both domestically and internationally. They’ve been around for over a century, offering a reliable way to move funds from one place to another. But why are they called “wire transfers”? The term dates back to the days when financial transactions were transmitted over telegraph wires. Although the technology has evolved significantly since then, the name has stuck, and wire transfers remain one of the most common ways to transfer money quickly and securely.

These days wire transfers are also known as “money transfers” and the two terms are often used interchangeably to describe the process of electronically transferring funds from one account to another.

In this article, we’ll explore some of the key aspects of wire transfers including speed, cost, security, convenience, and the regulations that govern these transactions.

How Wire Transfers Work

Wire transfers work by electronically transferring money from one bank account to another. The sender provides the recipient’s account details and the funds are securely moved through a network of banks until they reach the recipient’s account.

Speed and Efficiency

One of the main reasons people choose wire transfers is for their speed. Typically, domestic wire transfers can be completed within a few hours to a full business day, depending on the banks involved. International wire transfers may take a bit longer, usually between one to five business days. However, several factors can delay the transfer, such as differences in time zones, public holidays, or processing times at intermediary banks.

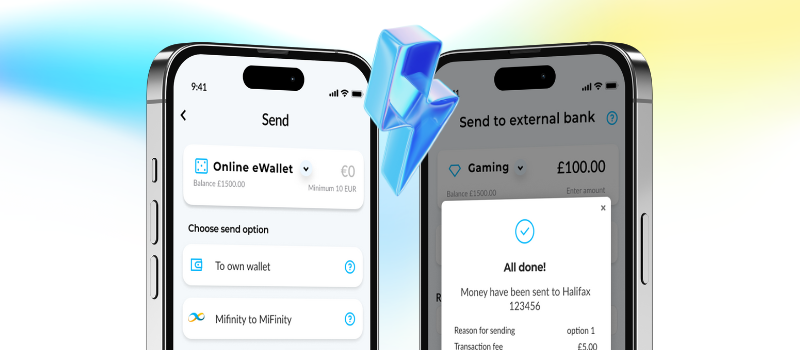

That said, digital services, including MiFinity, can significantly reduce transfer times as money can be transferred directly to your recipient’s eWallet. Don’t worry if they don’t have one, they can open a free account to receive their funds.

Cost and Fees

Wire transfers are generally efficient, but they do come with costs. The fees can vary widely depending on the provider, the amount being transferred, and whether the transfer is domestic or international. Some providers will charge a flat fee whilst others charge a percentage of the transfer value. Additionally, there may be other charges, such as currency conversion charges or fees from intermediary banks involved in the transfer process.

It’s important to be aware of these potential costs and to compare the fees across different banks or money transfer services. With the MiFinity eWallet, for example, when you send money to friends and family we only charge 1% of the transfer value and that’s capped at €10 max.

Security and Safety

Security is a top priority when it comes to wire transfers. These transactions are generally very secure, but as with any financial transaction, there are risks of fraud or scams. Wire transfers are difficult to reverse once completed, so it’s essential to ensure that you’re sending money to a legitimate and trusted recipient.

To protect your personal and financial information, most money transfer services, including MiFinity, use advanced encryption and secure servers to safeguard your data and money.

Convenience and Accessibility

Wire transfers are relatively easy to initiate, whether you’re doing it in person at a bank branch or online through a banking platform or eWallet. There are usually no strict restrictions on the amount you can transfer, although some banks or services may have limits based on your account type or transaction history.

It’s important to find a service that allows your recipient to receive funds in a way that suits them. For example, if they don’t have a traditional bank account, a transfer to an eWallet can be an excellent alternative. eWallets like MiFinity offer flexibility and accessibility, allowing recipients to access their funds digitally and use them for a wide range of transactions.

Regulations and Compliance

Wire transfers are subject to various regulations and laws designed to prevent fraud, money laundering, and other illegal activities. As part of these regulations, you may be required to provide additional documentation or information, such as proof of identity or the purpose of the transfer.

Services like the MiFinity eWallet are fully compliant with international financial regulations, ensuring that your transfers are secure and meet all necessary legal standards.

Why Choose MiFinity eWallet for Wire Transfers?

The MiFinity eWallet offers a modern, secure, and cost-effective way to send money. With competitive fees, fast processing times, and robust security measures, MiFinity provides an excellent alternative to traditional wire transfer services. Whether you’re sending money to a loved one overseas or making a payment for a business transaction, the MiFinity eWallet makes the process easy and accessible.

Sign up for MiFinity today and experience a better way to manage your international money transfers.