If you’re considering signing up for a MiFinity eWallet or have recently joined, you might be wondering how to use it for bank-to-bank transfers. This article will guide you through the benefits of using MiFinity for these transfers and provide easy-to-follow steps to help you get started.

Why Use a MiFinity eWallet for Bank-to-Bank Transfers?

When it comes to transferring money between bank accounts, the MiFinity eWallet offers several distinct advantages over traditional methods:

- Highly Competitive Exchange Rates and Low Fee : MiFinity offers some of the best exchange rates for bank-to-bank transfers, along with super low transaction fees. This means more of your money goes to your recipient rather than being spent on hidden charges.

- Convenience and Flexibility : Forget lengthy processes or multiple platforms. With MiFinity, you can complete your bank-to-bank transfer entirely within the eWallet app or desktop platform. It’s quick, secure, and easy to use.

How to Make a Bank-to-Bank Transfer with Your MiFinity eWallet

Here’s a simple step-by-step guide to help you transfer funds between bank accounts using your MiFinity eWallet:

Step 1: Activate Your MiFinity eWallet

Ensure your MiFinity eWallet is active. If you haven’t already, log in to your account, select the “Create eWallet” option, and choose the eWallet category that best suits your needs, such as “eCommerce” or “Travel”.

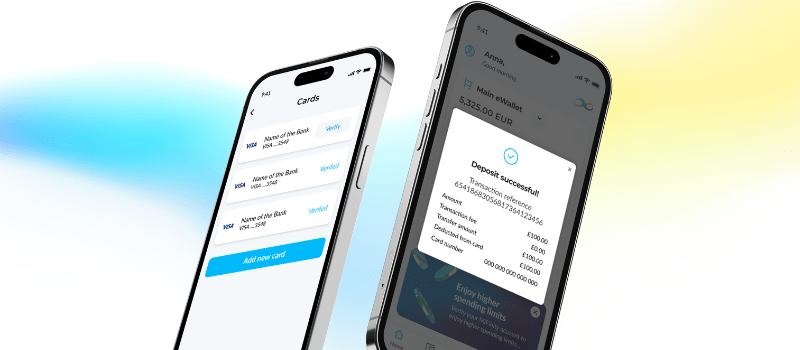

Step 2: Deposit Funds

Top up your new eWallet using one of the 75+ payment methods available. MiFinity supports various options to make depositing funds as simple as possible.

Step 3: Verify Your Identity

For security and regulatory compliance, you’ll need to verify your identity within the MiFinity eWallet. Follow the prompts in the app or desktop platform to complete this step before initiating a bank-to-bank transfer.

Step 4: Start Your Transfer

Select “External Bank Transfer” from the menu. First, choose the country you are sending money from and the currency you want to use.

Step 5: Enter Country and Currency Details

Choose the country where the recipient’s bank account is located and select the currency in which you’d like the money to be transferred.

Step 6: Review Transfer Details

Enter the amount you want to transfer and click “Calculate Fees”. MiFinity will display the exchange rate and transfer fees upfront, so you can see what a great deal you’re getting. If everything looks good, select “Get Started”.

Step 7: Confirm and Verify

Add the recipient’s details, including their full name, bank name, and account number. Double-check the transfer amount and click “Make Payment” to proceed. For added security, MiFinity will send a verification code to your registered mobile number. Enter this code and click “Proceed” to finalise the transfer.

Step 8: Transfer Successful!

You’ll receive a confirmation message letting you know your transfer has been successful. The recipient will typically receive the funds quickly, depending on the destination and banking network.

Bank to Bank Transfer Video Guide

Watch the video below to see how easy bank-to-bank transfers are with MiFinity:

Get a MiFinity eWallet for Your Bank-to-Bank Transfers!

With its competitive fees, excellent exchange rates, and user-friendly platform, MiFinity makes transferring money between bank accounts a breeze. Whether you’re sending money abroad or managing bank transfers locally, MiFinity provides a convenient and cost-effective solution.

Sign up for your free MiFinity eWallet today and enjoy seamless bank-to-bank transfers with confidence! Get started today!